Regis reports sustained growth in FY25 results

Last updated on 1 April 2025

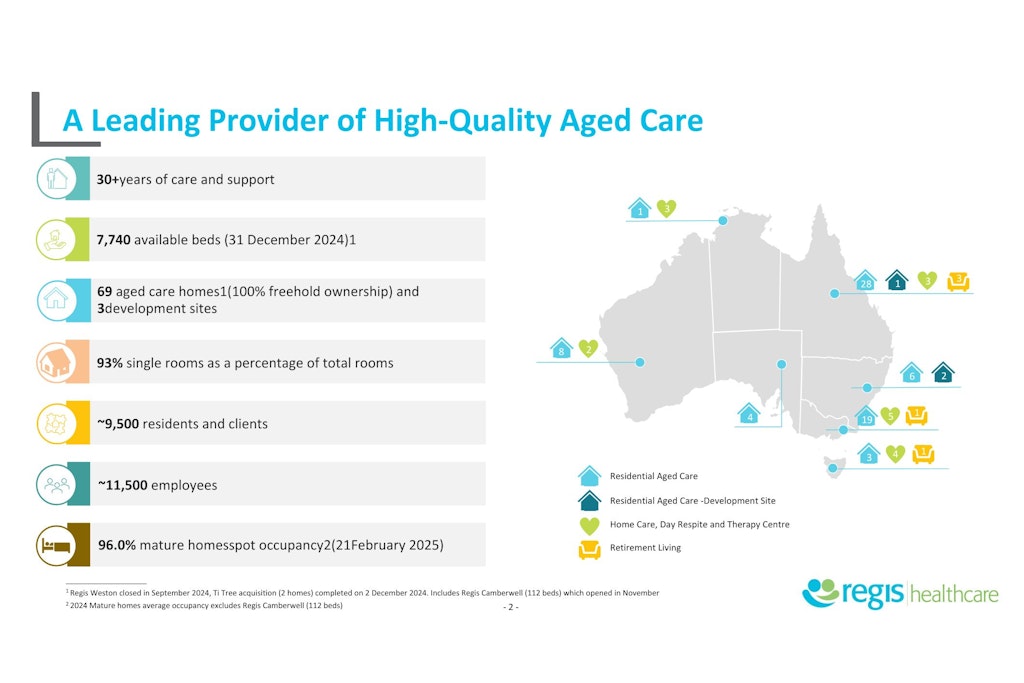

Regis Healthcare has delivered strong earnings growth and cash flow generation across the first half of Financial Year 2025 (FY25).

Revenue increased by 18% as Regis’ earnings before interest, tax, depreciation and amortisation (EBITDA), net profit after tax (NPAT), occupancy rates and overall star ratings improved.

These results were buoyed by ongoing growth as Regis opened its 112-bed greenfield development in Camberwell, Melbourne in November before acquiring two premium homes from Ti Tree Operations with 262 beds in the Mornington Peninsula in December.

A recent deal was also finalised with BodeWell Community Care to strengthen and grow its home care offerings.

Regis Managing Director and Chief Executive Dr Linda Mellors praised the organisation’s strong financial results, including occupancy uplift, revenue, EBITDA, NPAT and cash flow. She also reflected on a busy six months for Regis and the broader aged care sector.

“Care funding increased significantly from 1 October 2024, with higher AN-ACC to fund an increase in the care minutes mandate and aged care worker pay rises. We welcomed the passing of the new Aged Care Act in November 2024 with bi-partisan support, ahead of a 1 July 2025 effective date,” she explained.

“The Government’s response to the Taskforce recommendations will provide a financial boost to providers and has encouraged Regis to invest in further greenfield and brownfield developments.

“Regis finished the six-month period with significant net cash to support our growth agenda. We continue to invest significantly in strategic growth initiatives for the long-term success of our business.

“Our brand-new home in Camberwell, Victoria, opened to residents in November 2024, and we expanded and progressed our pipeline of greenfield developments in Melbourne, Sydney and Brisbane.”

Key results and operational highlights

- Revenue from services of $564.2 million, up 18% on pcp

- Underlying EBITDA of $68.1 million, up 31% on pcp

- Underlying EBIT of $44.4 million, up 523% on pcp

- NPAT of $24.4 million, up 301% on pcp

- Net operating cash flow of $208.6 million, up 37% on pcp, including refundable accommodation deposits (RADs) net cash inflow of $85.8 million

- Net cash of $179.9 million at 31 December 2024, up 965% from 31 December 2023

- Mature homes average occupancy of 95.7%, significantly up on 93.6% in pcp o Increase in occupied bed days from 1.217 million to 1.313 million

- Improvement in average overall star rating from 3.32 (Q1 FY24) to 3.56 (Q1 FY25)

- Average care minutes per resident per day increased from 210.1 minutes (Q1 FY25) to 215.3 minutes (Q2 FY25)

Elsewhere, staff expenses rose 16% as recruitment increased to meet mandated care minutes requirements. Regis cited last July’s 3.75% minimum wage increase, other enterprise bargaining agreement increases and non-staff costs such as consumables and utilities as significant expense increases over the six-month period.

Interestingly, a shift in consumer preference to pay 100% of their RAD was noted. This supported the overall increase in RAD net cash flow which was double what Regis achieved in the first half of Financial Year 2024.

Future gains will be made as providers can retain 2% per annum of new RADs (capped at five years) from July 1, 2025.

Regis added that its Ti Tree and BodeWell Community Care acquisitions are progressing well, with Regis’ organisational governance and processes already in place for its two new residential care homes.

“In January 2025, Regis announced the acquisition of BodeWell Community Care which increases the scale of Regis’ existing home care business in Melbourne and extends operations into South-East Queensland,” the organisation added.

“Revenue of the combined business doubles to ~$30 million with more than 2,500 clients. The transaction is expected to complete by 1 April 2025, subject to regulatory approvals.”

With Regis Camberwell now operating, attention has turned to new developments in Toowong (Queensland), Belrose and Carlingford (both New South Wales). Another pair of Melbourne land acquisitions at Essendon and Coburg will further strengthen the metropolitan presence in prime locations.

Regis Bulimba (Queensland) is planned to be closed later in the 2025 calendar year.

Moving forward, Regis remains focused on driving increased shareholder value after paying an interim dividend of 8.09 cents per ordinary share totalling $24.4 million.

“Regis welcomed the passing of the new Aged Care Act which is expected to improve sector returns. Regis continues to adapt to a changing regulatory environment and expects to benefit over time from new funding legislation, an increased ageing population, improved workforce availability, and strategic growth initiatives,” it said.

“Regis will continue to use its strong balance sheet, substantial debt facility and disciplined management of the business, to support the active pursuit of further material strategic acquisitions and greenfield developments to drive increased shareholder value.”