Aged care pay rise helps Aussie wage growth despite productivity concerns

Published on 19 May 2025

Australian wages are on the rise, buoyed by the latest instalment of aged care pay rises in March, which should see the Reserve Bank of Australia cut the cash rate this week.

However, there are broader concerns about the pay deals for the likes of aged care workers, childcare workers and public servants, with experts warning that they cannot be sustained if there is no increased productivity.

Key points: Wage Price Index update

- The seasonally adjusted Wage Price Index (WPI) rose by 0.9% in the March 2025 quarter, up from 0.7% in the preceding quarter and surpassing market expectations of 0.8%.

- Private sector wages rose 0.9% quarterly and 3.3% annually, unchanged from December 2024, while public sector wages grew 1% quarterly and 3.6% annually, up from 2.9% in December.

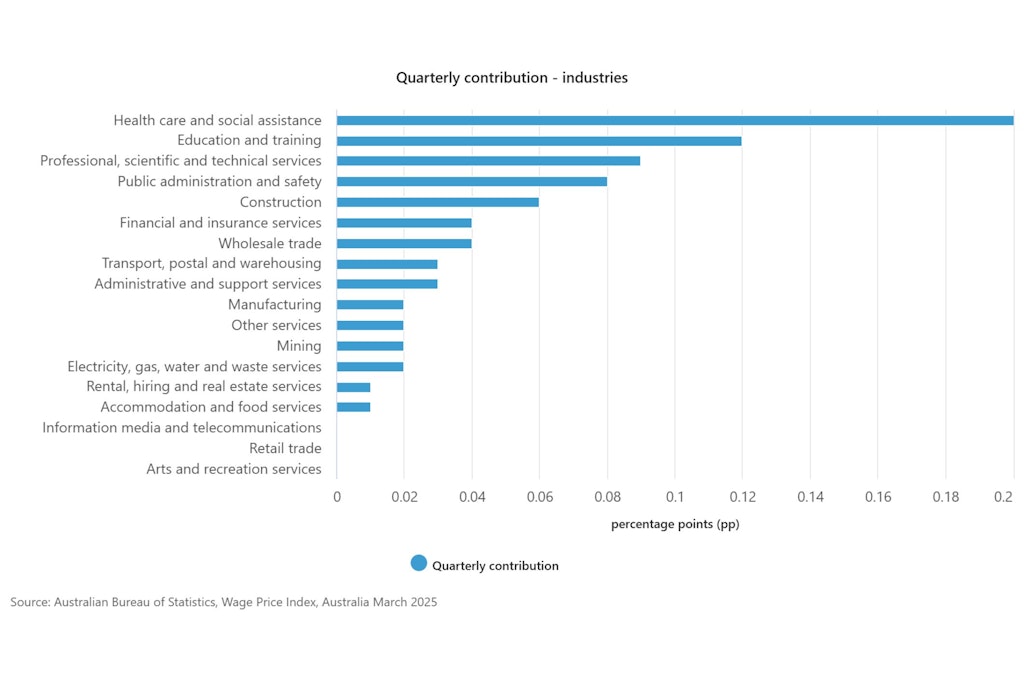

- The largest quarterly wage growth came from the Health Care and Social Assistance sector with aged care wage increases contributing to 1.4% growth.

- Real wages growth was the fastest annual rate since June 2020, while enterprise agreements contributed 54% to quarterly wage growth, the highest since September 2020.

In March, the first tranche of pay rises for registered and enrolled nurses came into effect following the Fair Work Commission’s final determination in the Aged Care Work Value case. Nurses received increases of between 2.3% and 13.5%.

The pay rises, which varied depending on nurse classifications, followed on from past victories for the sector which saw personal care workers and many other aged care employees receive minimum wage boosts of up to 25%.

Altogether, a strong showing in annual wages growth means there will be some relief for mortgage owners and Australian households as the cash rate is likely to drop to 3.85% from 4.1%.

The Federal Government appears to be the greatest driving force behind wage increases, though, and with productivity failing to rise in conjunction with wages, this could be a flash in the pan.

“If productivity growth does not pick up the inevitable question will be whether the strong wages growth will flow through to inflation,” KPMG Chief Economist Brendan Rynne said.

“This upside risk, combined with the risks related to trade policies around the globe, will test the RBA at its next meeting.”

It is likely that the aged care and childcare increases will add .25 percentage points to annual wages growth over the next 12 months.

The government is not overly concerned by growing inflation as a result, with Treasurer Jim Chalmers downplaying any risk that the broader economy will face negative repercussions.

“One of the most pleasing aspects of this wages data is we’re getting wages growth at the same time as inflation is coming down. This shows just how spectacularly wrong some people have been when they’ve talked about fears of a wage price spiral in our economy,” Mr Chalmers said.

Still, productivity growth sits at -1.2%, signalling that output is falling well short of input. Investments into systems and processes that reduce the workload burden on staff are examples of how individual organisations can improve their productivity.

“At an individual level, I increase my own productivity by making a shopping list before I buy groceries, so I don’t forget anything and avoid multiple trips to the supermarket,” RBA Head of Economic Analysis Michael Plumb recently said.

“At the firm level, productivity might be improved by implementing customer relationship management software to streamline communication with clients and automate routine tasks.

“At the economy-wide level – which is what matters for the central bank and our dual mandate of full employment and low and stable inflation – productivity reflects a multitude of decisions like these.”

Mr Chalmers and Employment Minister Amanda Rishworth praised the recent results and indicated that ongoing government investments will help to drive productivity and support the broader economy.

“We know that productivity growth is the key for strong and sustainable wages growth in the long term and that’s why our five-pillar productivity agenda across technology, human capital, energy, care and competition is so important,” they said.

There is also strength in the jobs market with the most recent 4.1% unemployment rate indicating that fewer workers are switching jobs. The savings made by retaining staff could benefit ongoing investments into productivity for organisations.

“This decline in job-switching has been driven by lower job mobility within the market sector and suggests that inter-firm competition to attract and retain staff has eased,” the RBA recently stated.

“As a result, there may be less upward pressure on wages in the near term than implied by other measures of labour market tightness, such as the unemployment rate.”