Data spotlights profitability divide between for-profit and not-for-profit providers

Published on 24 June 2024 (Last updated on 11 July 2024)

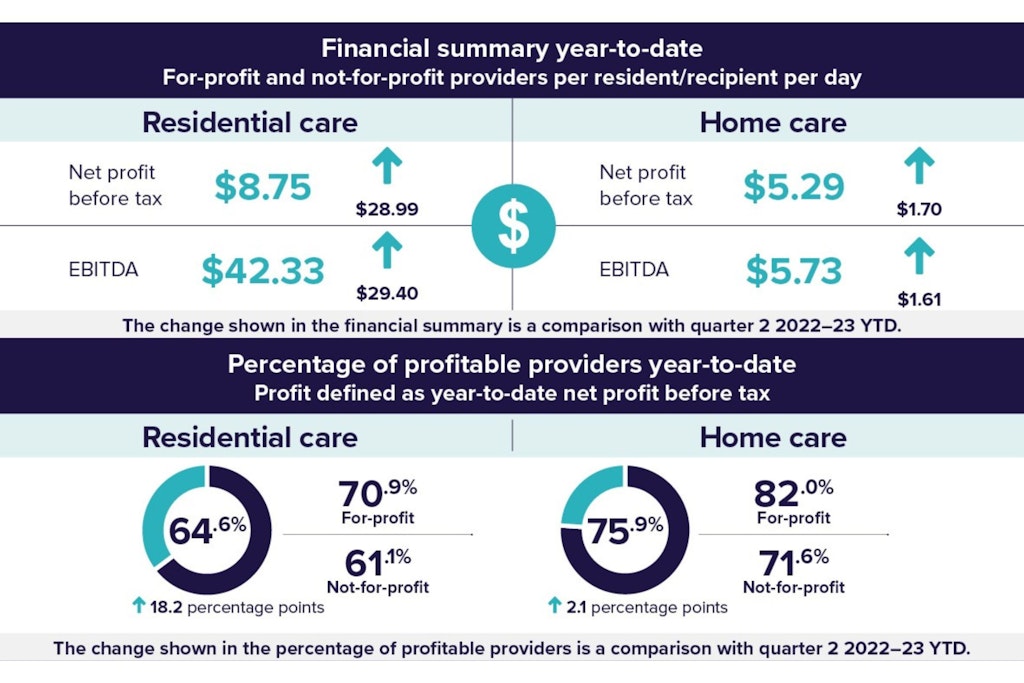

Residential aged care has seen notable financial improvement in the latest Quarterly Financial Snapshot as providers continue to outperform compared to the 2022-23 financial year.

Quarter-by-quarter gains are not as strong, however, despite more providers turning a profit in both the home care and residential care settings. Sector success in meeting care minute targets also has room for improvement as for-profit providers are still five minutes shy of 200 minutes per resident per day, while the sector has not met its Registered Nurse goals.

Key points

- The December 2023 year-to-date (YTD) results show an improvement in the overall financial performance of the residential aged care sector

- Net Profit Before Tax (NPBT) and earnings before interest, tax, depreciation and amortisation (EBITDA) increased for both residential and home care providers

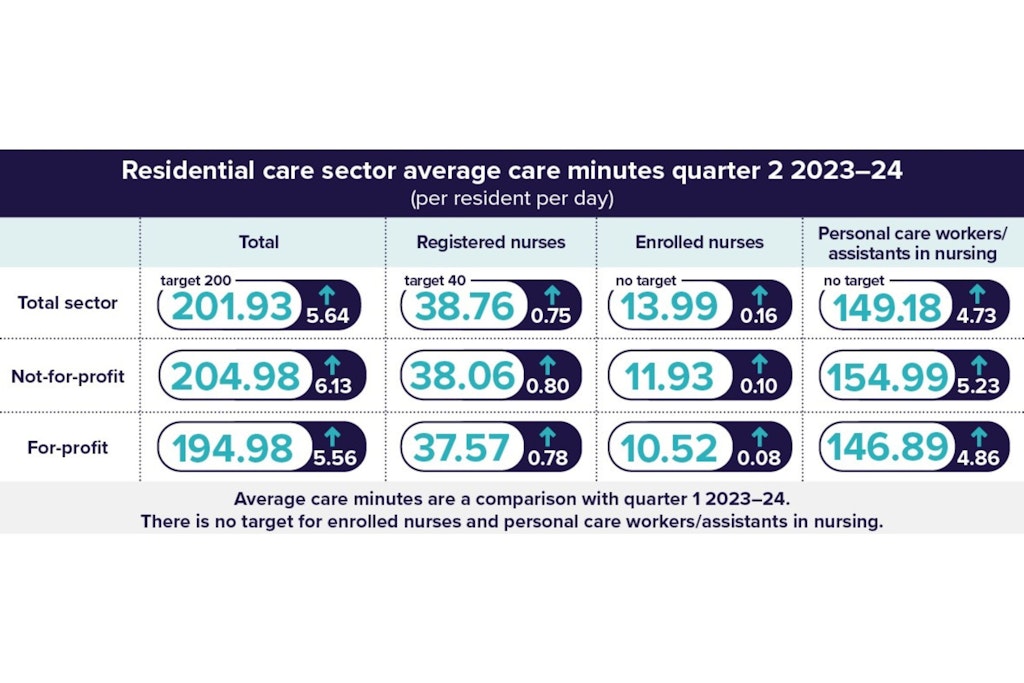

- The sector met the mandatory care minutes target, delivering an average of 201.93 care minutes per resident per day, but fell slightly short on registered nurse minutes

- The balance of unspent funds continued to grow in home care, indicating a need for better fund utilisation

Year-to-date results showcase improvements

Key comparisons between quarter 2 in 2022-23 and 2023-24 highlight just how far the residential care sector has come thanks to AN-ACC funding. Government data shows that:

- Residential care providers’ YTD EBITDA improved by $29.40 per resident per day, totalling $42.33, while NPBT performance improved by $28.99 for a net profit of $8.75 per resident per day

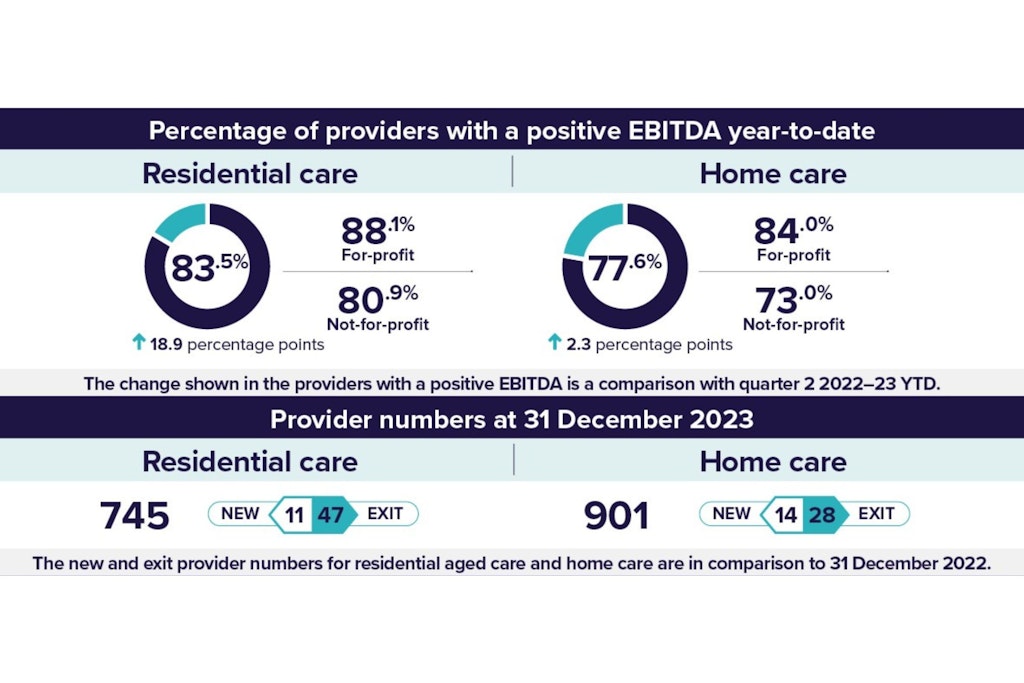

- The proportion of residential care providers reporting a positive YTD EBITDA position also improved to 83.5%, up 18.9 percentage points

- The median EBITDA margin for the residential sector increased to 9.75%, resulting in an EBITDA return of $9.75 for every $100 of revenue earned

As always, there are expectations that year-end adjustments will see expenses increase over the remaining two quarters of 2023-24. The Government reports that providers have written off approximately $289 million from 1 July to 31 December 2023 in bed license amortisation, one contributing factor to expenses.

Additionally, while the YTD data shows significant improvements, quarter-by-quarter financial performance has slowed. Net profits decreased by $1.61 for residential care while home care dropped by 38 cents.

Growing care minute requirements are a contributing factor to residential care’s slight dip in profits with providers ramping up spending to meet their requirements. For-profit providers, many of which are still below the sector’s 200-minute target, are among those who will see their expenses increase.

Care minutes expose profitability gap

The sector’s total care minutes results jumped by 5.64 minutes to reach 201.93 minutes in quarter 2, surpassing the 200 care minutes per resident per day target. This is a welcomed achievement but it does expose other potentially concerning trends.

- Not-for-profit residential care providers reported a total average of 204.98 care minutes compared to 194.98 by for-profit providers; both saw positive increases in their total results despite the discrepancy

- The sector’s Registered Nurse minutes average is 38.76, still more than one minute shy of the 40-minute target despite an increase of .75

- Although not-for-profits are on average performing better for care minutes, they are also less likely to be profitable or have a positive EBITDA compared to for-profit providers

This profitability gap reflects recent data published in Australia’s Aged Care Sector Mid-Year Report by the UTS Ageing Research Collaborative (UARC). They found that providers achieving larger financial gains are still underspending on direct care with homes meeting or exceeding their staffing targets operating near breakeven or at a loss.

As highlighted by the Government, direct care staffing expenses will increase as providers cannot continue to fall short of their targets for sustained periods. With for-profit providers also reporting fewer care minutes from Enrolled Nurses and personal care workers/Assistants in Nursing, additional staffing expenses are not going to be exclusive to RNs.

Given just 19% of for-profit providers met both their total care minute targets and RN care targets, overall sector profitability could change drastically in the next few Quarterly Financial Snapshots.