StewartBrown reports a positive financial turnaround amid ongoing challenges

Last updated on 24 January 2024

Has the aged care sector finally turned the corner regarding financial viability? The latest findings from Stewart Brown suggest there is a mixed bag of results for the sector as it has returned to form with an average operating surplus, although it warns that marginal gains achieved might not last long.

Key points

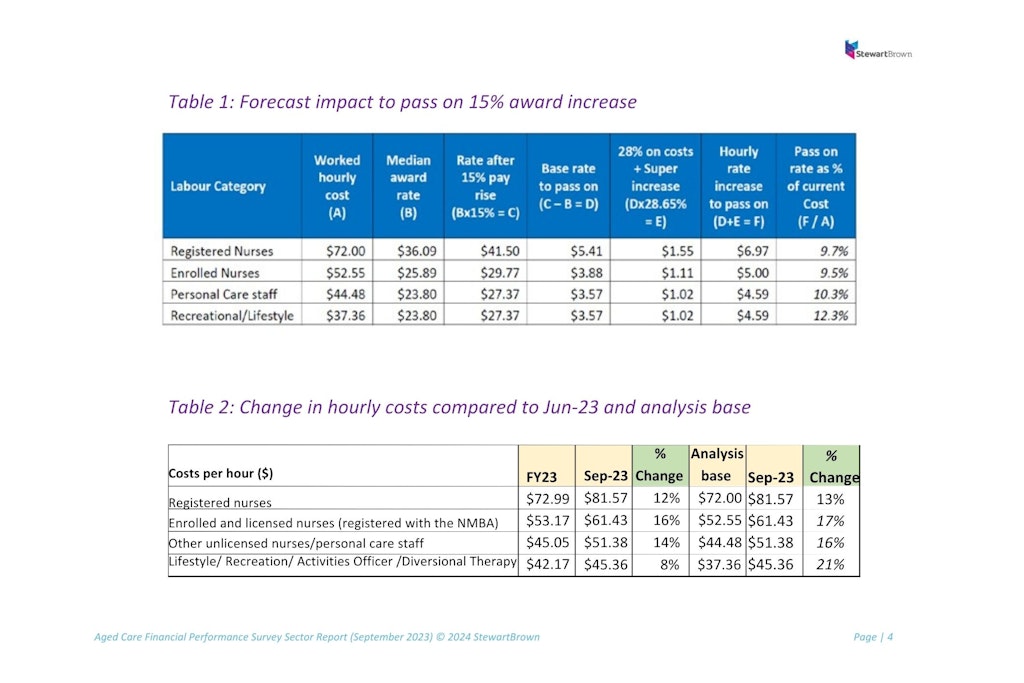

- StewartBrown’s September 2023 Aged Care Financial Performance Survey highlights the positive impact of the transfer to the AN-ACC funding model and the direct care income streams such as the 15% Award rise for direct care staff

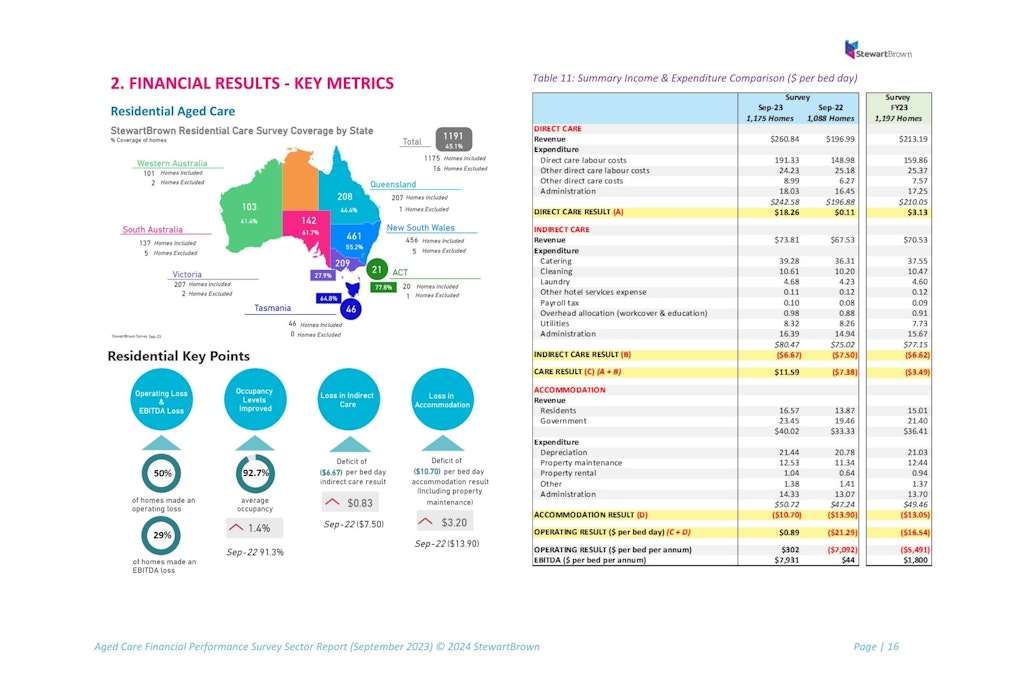

- Residential aged care homes reported an average operating surplus for the first time since September 2020, returning a $0.89 per bed day (pbd) surplus for the three months ending September 30, 2023

- The figure is a considerable improvement from 12 months prior when providers reported an average operating deficit of $21.29 pbd

- Notably, despite the positive quarterly results, it is crucial to remember the industry’s volatility, as evidenced by a full-year operating deficit of $8.43 pbd in the same year

Direct care revenue offset by expenses

A closer look at the direct care sector reveals that staffing levels have increased significantly, responding to the 24/7 RN requirement and the mandatory direct care minutes implemented from October 1, 2023. Survey participants reported an average of 36.12 RN minutes per resident per day, alongside a total of 196.36 direct care minutes per resident per day.

While these figures fall slightly short of the 40 and 200-minute targets, they represent a substantial 18.6% increase in RN minutes and a 5.3% increase in total direct care minutes compared to the September 2022 survey.

“The new increased AN-ACC starting price of $253.82 (up from $243.10) from 1 December 2023 will bring a further $11 increase on average to the direct care revenue. While this has been focused on direct care as part of AN-ACC funding, it is unlikely that Providers will be able to use this funding to increase their staff minutes as they are still making losses in the indirect care and accommodation cost centres, and this direct care margin is likely being used to help off-set those losses,” stated the Report.

The challenging task of recruiting to meet care minute targets is also likely to result in ongoing losses as providers look to more expensive agency staff when shortfalls occur.

Indirect care and accommodation losses continue

Despite showing signs of improvement over the last 12 months, accommodation and indirect care expenses continue to have the greatest impact on financial success. StewartBrown reported a deficit of $10.70 pbd for accommodation-related costs and a deficit of $6.67 for indirect care costs.

Positively, accommodation losses have improved by $3.20 from September 2022, with an increase in the Maximum Permitted Interest Rate (MPIR) helping to strengthen accommodation revenue over the last few months. However, the increase in revenue from resident and Government sources has been unable to keep up with rising expenditure costs.

Homes are turning to additional services to overcome losses with just over 40% providing additional or extra services to limit the damage. The authors have renewed their calls for a higher consumer contribution, where possible, to cover everyday living services, and for an improved accommodation model where rent is based on the actual upfront contribution paid.

2024 financial year forecast

By looking at the September 2023 results and projecting into the coming months, StewartBrown believes there will be an overall surplus of $3.57 pbd for the entire 2024 financial year period.

This comes with plenty of caveats, as always, and it will certainly depend on whether providers move to increase wages for non-direct care staff. A stabilisation of labour costs should provide plenty of consistency if providers do not have to drastically scale up their expenditure to meet direct care minute quotas.

It remains to be seen, however, if the sector can comfortably move away from the fine line it treads. The increase in the Aged Care Funding Instrument (AN-ACC) subsidy price from December 1, 2023, played a pivotal role in avoiding a projected average deficit of $2.98 pbd for the sector so there is no certainty that the majority of providers will have a positive financial outlook.