How philanthropy and ESG considerations can benefit aged care

Last updated on 24 January 2024

Environmental, social and governance (ESG) investing has gained a considerable amount of traction in the investment space, and there are important considerations for aged care organisations.

In terms of investment strategies, providers should look at ESG investing from two perspectives: where organisational and board investments lie and where external donations and philanthropic contributions are coming from.

Understanding how ethical investing plays a role here could be a major factor in attracting income over the coming years and decades. David Hurley, Associate Partner at Perpetual Limited, highlighted some of the most important ESG considerations for executives and board members.

“Environmental, social and governance considerations are talked about a lot and we use a lot of buzzwords in this particular sphere. But looking at the core of it, these issues do matter to consumers, they matter to investors and they matter to stakeholders,” he explained.

“On a surface level when we think about ESG we think more about mining companies or large corporates that have major environmental impacts. But it’s important for everyone and it will affect everyone in different ways. The key is to identify the areas in your business that have the largest impact in this space.”

As an example, providers could take a look at the composition of their board. Diversity and inclusion is one of the ‘governance’ factors for ESG and certain investors are more likely to be attracted to an organisation with a diverse board.

Similarly, what are your board members investing in? Mr Hurley pointed out that climate change, biodiversity and human rights are global trends seemingly unassociated with aged care, but individual investments in mining or heavy-polluting organisations could conflict with your organisational values. Shareholder and stakeholder engagements are often a driving factor in changing investment avenues.

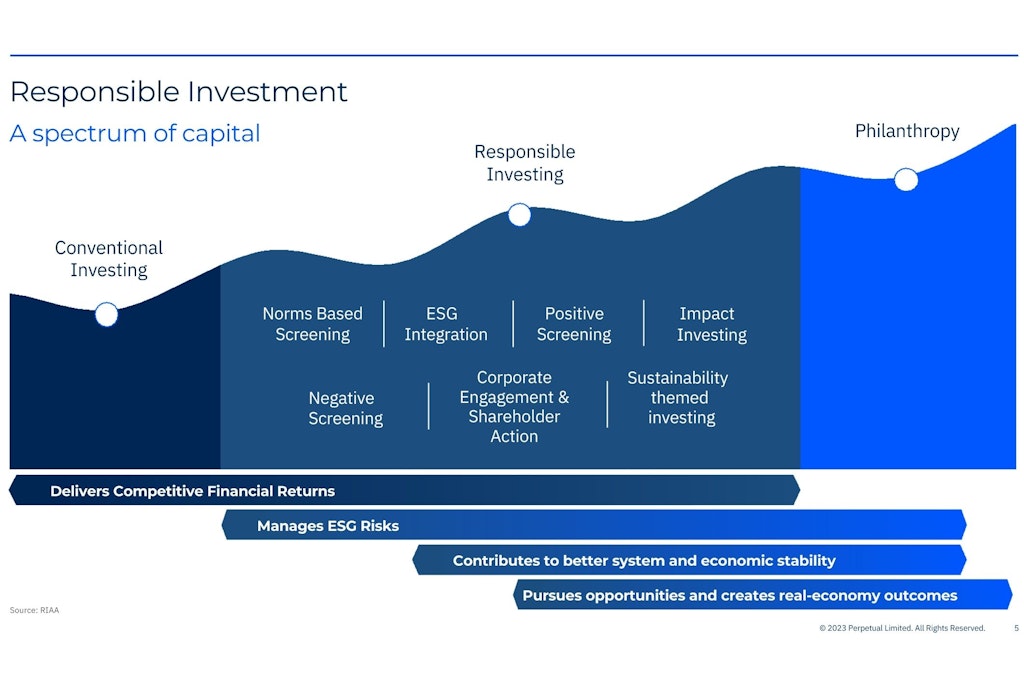

From conventional to responsible investing

All individual and organisational investments start conventional. But if you adopt ESG considerations into your practices there will be a shift through to responsible investing. Philanthropy sits at the very end of the scale.

“Conventional investing, you’re purely focused on financial return. As you move into that responsible investment space you still want a return but you’re starting to consider some of those ESG factors,” Mr Hurley explained.

“It might be screening out the worst-case offenders from your portfolios or refusing to do business with organisations exposed to areas you’re not comfortable with, such as gambling or tobacco.”

“Philanthropy doesn’t look for any financial return so it’s purely social or environmental outcomes where philanthropists are happy to support you in providing money but they do want to see a benefit coming back that’s not necessarily financial,” he added.

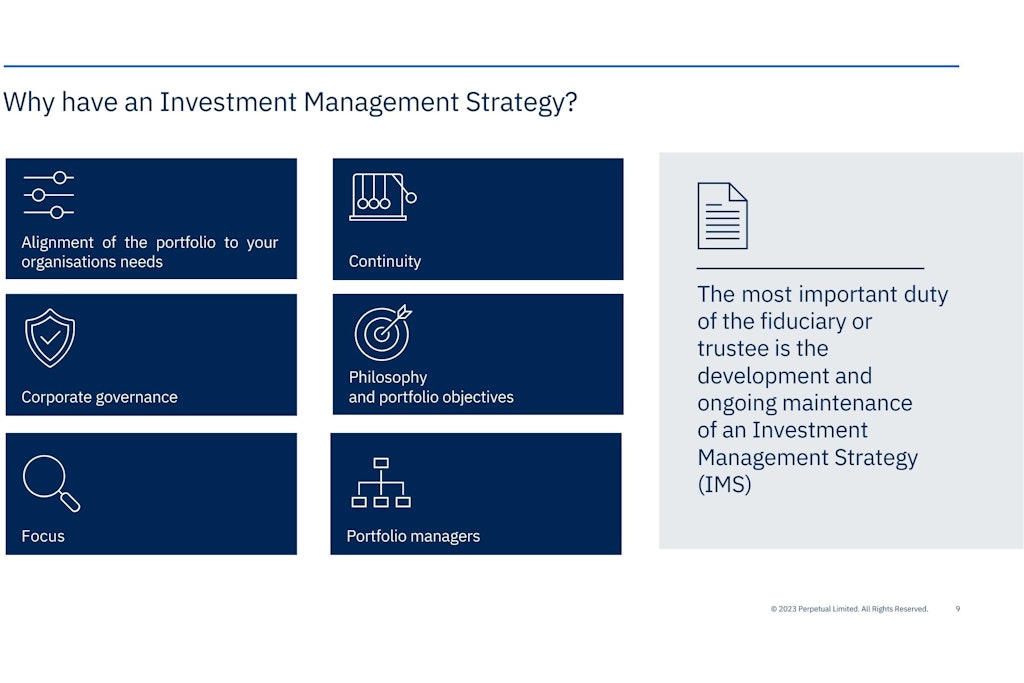

If you’re in a position to reevaluate your investment management strategy, it’s important to consider what your investment beliefs and values are as an organisation. The next step is to recognise how those factors could impact your investment return.

“You want to articulate that there is a plan or thought behind your investment decisions. How have you taken a measured approach to what you’ve constructed in terms of your portfolio? A robust investment management strategy sets the framework to look at different investment options and execute an investment portfolio that incorporates ESG values,” Mr Hurley added.

It’s also at this point where responsible investing blurs with impact investing. Impact investing sits in a hybrid space where financial benefits are equal to social benefits, and in many ways, it benefits aged care as not-for-profit providers are among those who could benefit the most from ESG-influenced donations and philanthropy.

Targeting philanthropic contributions

Philanthropy forms a key component of ESG investing and this is where aged care providers will find themselves on the receiving end of major donations.

Clementine Lucas, Philanthropy Services Manager, Perpetual Limited, outlined that almost #3 billion is distributed to the not-for-profit sector through structured philanthropy. Philanthropy Australia, the sector’s peak body, predicts this figure to double by 2030.

“When we talk about philanthropy we’re referring to structured giving and this is distinct from mass market or other forms of giving, that might be direct donations to charities, volunteering or crowdfunding. Structured giving requires a vehicle, a public ancillary fund, a private ancillary fund or a charitable trust,” Ms Lucas explained.

“To set a clear philanthropic strategy will increasingly be critical to help support and affect change in this sector and should be prioritised as an important income revenue stream.”

Aged care providers must be a deductible gift recipient (DGR) to receive philanthropic funds. But for those who can attain investments and funding through this means, it offers an impactful source of income for key projects designed to impact residents and the wider community.

Incorporating philanthropy into your investment management strategy could provide countless benefits, particularly if it allows you to target funding programs such as Perpetual Limited’s IMPACT philanthropy application program (IPAP).

“The majority of the assessing we do on your organisation is around governance… so if you’re well governed, you have a strong strategy and you’re outcome-focused,” Ms Hurley explained.

“Our philosophy at Perpetual is to fund an organisation’s greatest need so we don’t necessarily need to see a project that is ground breaking and innovative. Your top priority you’re seeking, we want to fund.”