Is retirement living the cure for Australia’s housing crisis?

Published on 11 April 2024

Retirement living construction activity levels are on the rise and industry leaders see this as a perfectly timed opportunity to help reduce the impact of Australia’s housing crisis.

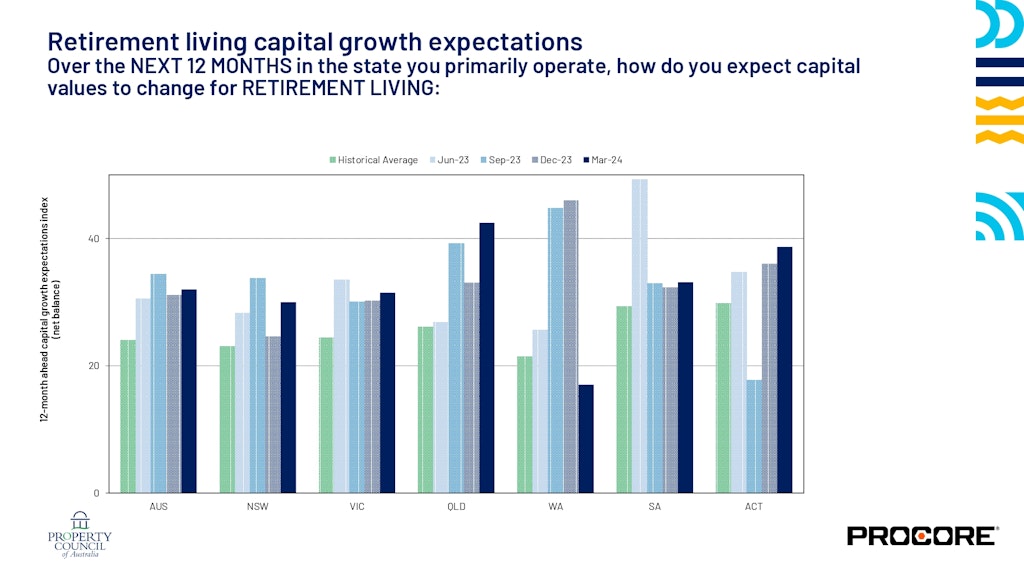

Data from the latest Procore/Property Council Survey shows strong confidence around construction activity, while capital value growth sentiment has rebounded after a slight decline.

In addition, confidence in retirement living construction activity is at its highest since December 2021 and its forecasted confidence levels are set to be greater than residential, office, retail and hotel construction combined.

This means aged care providers operating within the retirement living space are among those benefiting from major investments into retirement communities, or more commonly now, vertical retirement living centres.

And with Australia requiring 1.2 million homes by 2029, the booming retirement living industry is set to play a pivotal role over the next decade, according to Retirement Living Council Executive Director Daniel Gannon.

“The Master Builders Association only this week forecast that the Australian Government will fall short of its target by 112,675 homes, but there’s a silver lining to this scenario. “In order to maintain existing market demand, the retirement living industry requires 67,000 units to be built by 2030,” Mr Gannon said.

“This would represent 59 per cent of the gap identified by the MBA, meaning age-friendly communities can help the government solve Australia’s housing supply problem.”

“With the number of Australians over the age of 75 set to increase from two million to 3.4 million by 2040, more age-friendly housing that keeps people out of hospital and aged care facilities must be supported by all levels of government,” he added.

Uncertainty in the construction industry itself is keeping Mr Gannon relatively coy on the full potential of capital growth, however. He said that variables such as rising construction costs plus materials and labour shortages could place a handbrake on much-needed supply.

And like most things, legislative reform will play its part for better or worse.

“The other variable for the retirement living sector is legislative reform, which is taking place in every corner of the country and impacting two-thirds of Australia’s retirement living markets,” Mr Gannon said.

“This is particularly relevant in WA, one of the states currently undergoing legislative reform, with the survey showing a sharp decline in forecast capital value growth.”

“This provides an important reminder that if these reforms make it harder for operators to build and operate age-friendly communities, it could tighten the supply clamp at a time when confidence remains high, construction activity is strong, and when the nation needs housing.”

Mr Gannon added that a greater investment into retirement living could save close to one billion dollars annually, while he has previously spoken of its benefits for home care. He said a home care reform system that incorporates retirement communities can streamline how aged care services are delivered to increase financial efficiency and quality care outcomes.