Acquisition led expansion remains key growth strategy for providers – BaptistCare announces buy-out of Keyton’s Western Australian retirement village portfolio

Last updated on 13 November 2025

Along with Scape Australia’s $3.8 billion price tag for Aveo and Regis’ slew of recent acquisitions, the market is showing signs of heating up. Provider confidence looks to be rising with consistent moves into large-scale acquisition positions. The move has attracted significant interest from economists noting the strengthened yields from the aged care sector, particularly retirement living. BaptistCare is joining the ranks of providers who say they are taking on more to do more, and can financially maneuver to do so. On the other side of the same coin, the strategy to divest, so as to maneuver into a position for highly flexible growth, particularly in new geographical markets, is a development strategy many small to medium players are opting for.

Acquisition scope

This week BaptistCare has announced that it has formally entered into an agreement to acquire Keyton’s Western Australian retirement village portfolio.

The agreement covers BaptistCare taking over full ownership and operation of ten retirement villages, eight situated in central Perth as well as two sites on Perth’s periphery. In Mandurah and Bunbury, the provider will be acquiring 1639 offerings in total, 1568 independent living units (ILUs) and 71 independent living apartments (ILAs).

Transition intentions

The group has been open about transition approach and schedule. The speed of take-over is an element of interest in the recent ownership shifts, from announcement to comprehensive ownership, as well as operational responsibility, transitions have been erring on the shorter side as compared with other sectors.

BaptistCare confirms that it will be taking over full operation of all the sites in the coming months, while also seeking to collaborate with in-situ teams on site to enable a smooth transition for the entirety of the 2080 residents affected.

The provider has additionally publicly stated that they intend to offer continued employment to over 50 existing Keyton WA staff.

Keyton leadership

Nathan Cockerill, CEO of Keyton has also publicly commented on the acquisition decision. He shares that the decision to divest the organisation’s WA portfolio was not an easy one but it was the right decision.

“I am immensely proud of our WA staff and their commitment to residents and to making this transition a successful one. They are the reason our villages are in such good shape, and they will be the reason the villages will continue to thrive with BaptistCare,” Mr Cockerill commented.

“We are pleased to transition our villages to BaptistCare who share our values and vision to provide the highest quality care and services to residents, as well as provide an environment in which our staff can flourish with the new expertise, infrastructure and long-term security that their organisation provides.”

Cockerill likewise comments on a divestment strategy that seems shared by many small to medium players. Along with Rockpool, who highlight the capital from Regis will allow them to pursue boutique aged care offerings under their vision, Keyton looks to be following in similar footsteps.

“This sale will allow our business to focus on our growth strategy and opportunities to develop new or acquire existing communities on the eastern seaboard, particularly in Sydney, Melbourne, Brisbane and Gold Coast, as well as in the ACT.”

Growing the WA footprint

BaptistCare’s CEO, Charles Moore shares that he and the leadership team are excited to grow the BaptistCare family in WA, and welcomes residents and employees from all sites and villages.

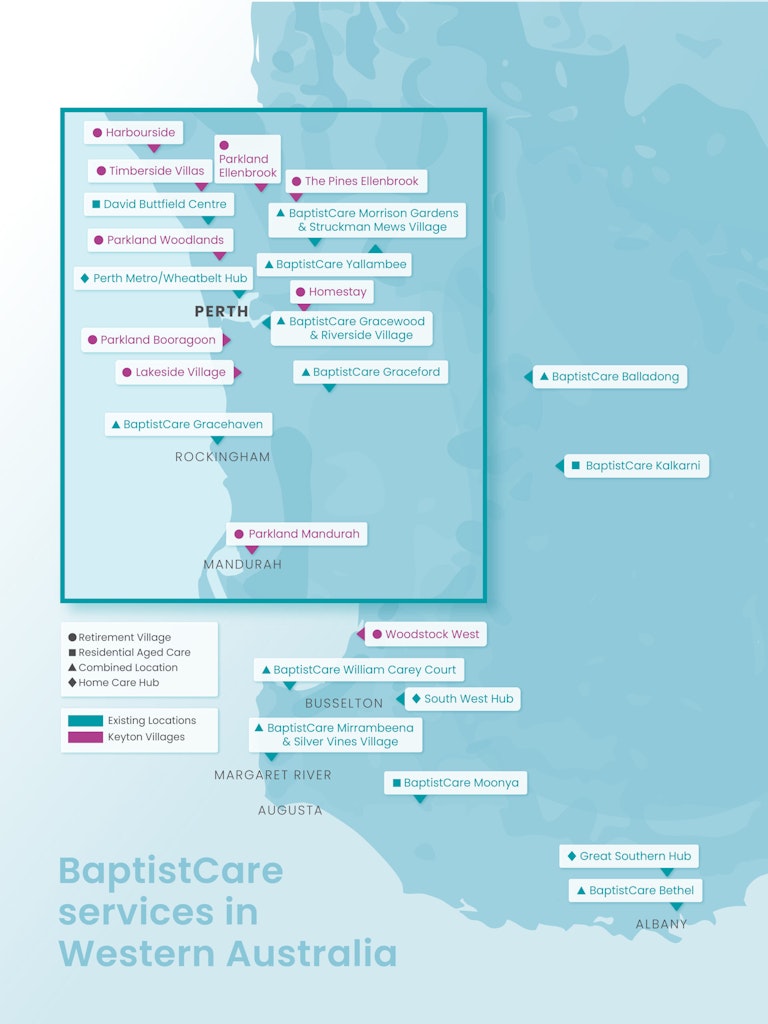

“We are thrilled to expand BaptistCare’s presence in Western Australia and welcome a large new community into the BaptistCare family. The portfolio complements our existing 10 villages, 12 aged care homes and three Home Care hubs in WA”, he says.

“It’s been our priority for more than 80 years to care for older Australians, and now as a national organisation, we’re excited by the scale, resources and expertise we can bring to this next chapter.”

Continuing, Moore says, “Our focus is on connecting with employees, residents and their families across each village, to listen and understand their needs. We want to build on the excellent services already in place, while ensuring the long-term security, investment and quality of care that being part of BaptistCare can offer.”

Final numbers

BaptistCare shares that after the completion of this acquisition and related operational assets, it will see its national portfolio expand from 35 to 45 retirement villages.

The ILU figures will rise from 2100 to 3739, and those supported in retirement living situations will rise from 2700 to 4700 residents.

Growth and evolution

As the sector continues to navigate considerable challenges, instances of financial agility and plans for growth, whether in acquisition or capital raising, is lauded by financial experts as a sign of health for the sector.

At the heart of aged care is the need, requirement, and often earnest professional goal, to secure excellence in care for seniors. Underpinning this must be a sector that is able to cover its operational, expansion and innovation costs. To be healthy for the most vulnerable in its midst, the sector must be sustainably healthy in ability to meet the financial needs of the now, and the sizable demand coming down the line.

BaptistCare sees this acquisition as a marker in an onward growth and evolution journey, as the organisation seeks to meet its vision of supporting ‘every individual to live well’.